excise tax division nc

Checks should be made payable to. Businesses governments and consumers adjust their tax rates when combined tax rates become prohibitive.

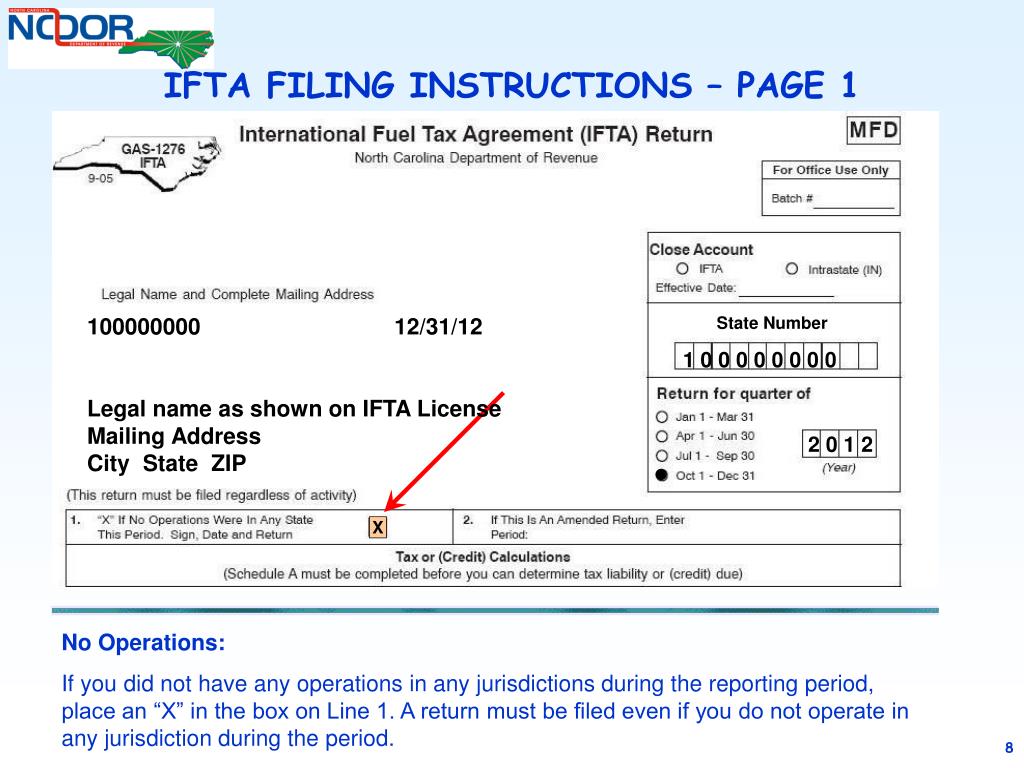

Motor Carrier Registration Excise Tax Division 1 July Ppt Download

Online approval takes 15 minutes.

. EO Statistics see Statistical Information About Tax Exempt Organizations. You can get an EIN for your North Carolina LLC online by fax or by mail. The National Firearms Act NFA 73rd Congress Sess.

82634 percent deposited to the General Revenue Fund. EO Tax Law Training Articles. Publication 1779 Independent Contractor or Employee Brochure PDF.

Per Jones County Ordinance all deeds must have the tax parcel ID number on the first page of the document. Division of Travel and Tourism NC. What This Means for You.

Excise Tax Division Tax Administration North Carolina Department of Revenue 3301 Terminal Drive Suite 125 Raleigh North Carolina 27604 February 2022. North Carolina NC Semiannual refund of NC state sales and use tax. 45-37a7 trustees satisfaction of deed of trust.

The office of the Division Counsel TEGEDC provides legal advice services and litigation on program matters including tax issues relating to. NC Sales Use Tax Technical Bulletin 17-2 North Dakota ND Exempt. PRIVILEGE LICENSE TAX Issued by.

0095 percent of the gross value of all-natural gas andor casinghead gas 0095 of 1 percent. Additional Excise Tax on Petroleum and Gas. Access forms form instructions and worksheets for each tax division below.

1236 was enacted on June 26 1934 and currently codified and amended as IRC. EO Update e-Newsletter e-Postcard see Form 990-N. You may search for a specific form by typing in the search bar or sort the list by clicking on any of the column headers.

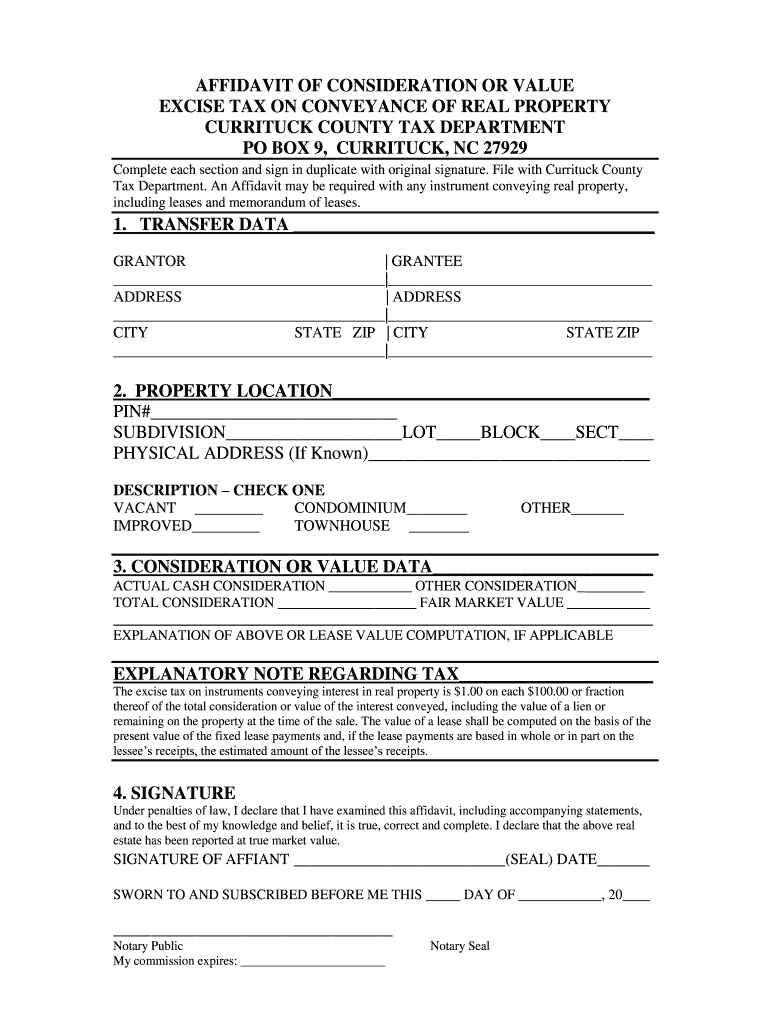

Excise tax stamps is 100 per 50000 of consideration on property. Publication 15 Circular E Employers Tax Guide PDF. 2021-180 in the North Carolina General Assembly.

085 percent of the gross value on each barrel of petroleum oil 0085 of 1 percent. Applying for an EIN with the IRS is free 0. Its not uncommon for New Jersey residents to cross over the border into Delaware to shop for exampleits often cheaper there even with that gross receipts tax at play.

Secretary of State UCC Division PO Box 29626 Raleigh NC 27626-0626. You may filter by division category and. LLC University will show you how to get an EIN Number Federal Tax ID Number for a North Carolina LLC.

Fax takes 4 business days. The list is currently sorted first by division and then by category. Hypothecated security addendum to deed of trust.

North Carolina should not count on a tax revenue windfall from online sports gambling. And mail takes 4 weeks. Department of Economic and Community Development Raleigh NC 27611.

If legalized online sports betting could bring the. Publication 15-A Employers Supplementary Tax Guide PDF. Register of Deeds PO Box 189 TrentonNC 28585.

53The law is an Act of Congress in the United States that in general imposes an excise tax on the manufacture and transfer of certain firearms and mandates the registration of those firearms. For information on a wide variety of public and private programs request a free copy of ACCESS North Carolina produced by the Vocational Rehabilitation Services NC. If NC sales and use tax is incurred for direct purchases by the University of tangible personal property contact Controllers Office to initiate request for a refund via Form E-585.

Satisfaction of security instrument by secured creditor ncgs. Affidavit of satisfaction of security instrument by attorney licensed to practice law in north carolina. In fact New Jersey has taken steps to address this.

The Division Counsel Tax Exempt and Government Entities is the principal legal advisor to the Division Commissioner TEGE and to the Division Commissioner SBSE on employment tax issues. For further information see Informational Bulletin MFT-2022-01 on our website at dorgeorgiagov and IFTA Inc. Department of Human Resources and distributed in cooperation with write to.

Suspension is effective March 18 2022 suspending the collection of motor fuel excise tax from March 18 2022 through May 31 2022.

Us Treasury North Carolina Provide Excise Tax Relief Wine Beer More

Motor Carrier Registration Excise Tax Division 1 July Ppt Download

North Carolina Alcohol Taxes Liquor Wine And Beer Taxes For 2022

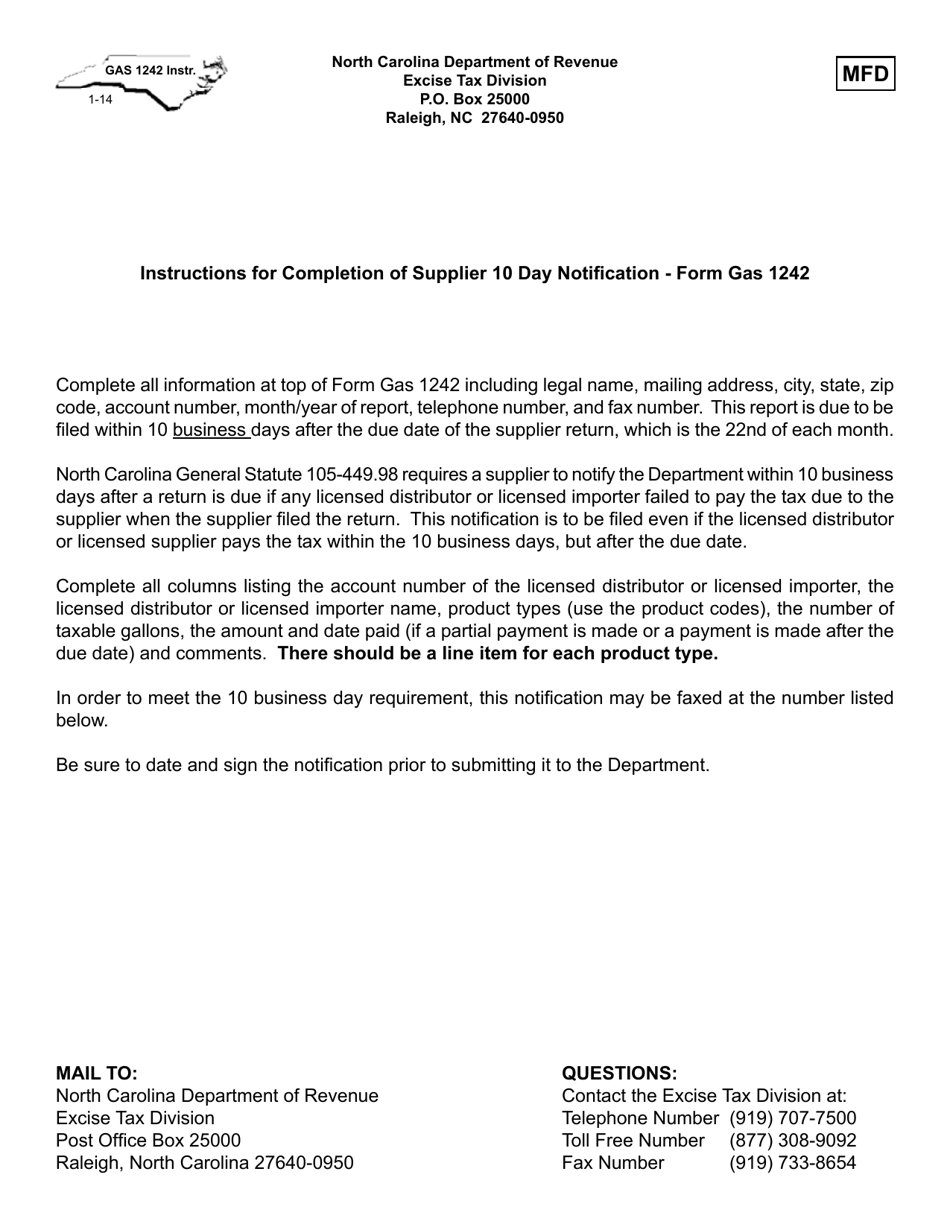

Download Instructions For Form Gas 1242 Supplier 10 Day Notification Pdf Templateroller

John Panza Director Excise Tax Division Nc Department Of Revenue Linkedin

North Carolina Department Of Revenue Directive

Ppt Completing An Ifta Tax Return Powerpoint Presentation Free Download Id 527733

Ifta Newsletter 2011 March State Publications I North Carolina Digital Collections

Download Instructions For Form Gas 1242 Supplier 10 Day Notification Pdf Templateroller

Motor Carrier Registration Excise Tax Division 1 July Ppt Download

Nc Affidavit Of Consideration Or Value Excise Tax On Conveyance Of Real Property Fill And Sign Printable Template Online Us Legal Forms